Calculating your lead generation ROI is the pivotal moment when marketing stops being a cost center and starts becoming a predictable revenue engine. It's how you measure the profitability of your marketing campaigns by weighing the revenue you've generated against your total investment. In short, it’s the only way to know if your efforts are really paying off.

This guide provides a clear breakdown of how to calculate ROI, explains common challenges, and shows how modern tools can help you overcome them.

Why You Absolutely Cannot Skip Calculating Lead Generation ROI

In today's market, just generating a pile of leads isn't enough. You have to prove that every dollar you spend contributes directly to the bottom line. Calculating your return on investment is what lets you shift the conversation from, "Hey, we got 5,000 clicks!" to "We spent $20,000 and closed $80,000 in new business."

That single shift—from activity metrics to outcome-based results—is what separates top growth teams from everyone else. It gives you the cold, hard data you need to justify your marketing spend, fight for a bigger budget, and earn a seat at the revenue table.

Before we dive into the formulas, let's get a quick overview of what you'll need to pull together for an accurate calculation.

Table: Core Components of Lead Generation ROI

| Component | What It Is | Why It Matters |

|---|---|---|

| Total Marketing Spend | The complete cost of your campaign, including ad spend, tools, and labor. | This is the "I" in ROI. Without an accurate cost, your entire calculation is flawed. |

| Total Leads Generated | The number of new contacts or inquiries produced by your campaign. | Measures the top-of-funnel effectiveness of your efforts. |

| Lead-to-Customer Rate | The percentage of leads that convert into paying customers. | Connects your marketing activity directly to sales success. |

| Average Revenue per Customer | The average amount of money a new customer brings in. | This is the "R" in ROI, quantifying the financial return of your efforts. |

Having these four components ready is the first step. They form the foundation of any meaningful ROI and impact analysis and ensure the final number you get is one you can trust.

Justify Marketing Spend and Secure Budgets

Without solid ROI numbers, marketing teams are often on the defensive, trying to justify their existence. But when you can draw a straight line from your campaigns to closed deals, you change the entire dynamic. Marketing is no longer an expense; it's a core driver of the business.

Here's what an accurate lead generation ROI calculation empowers you to do:

- Prove Your Value: Show leadership the concrete numbers that prove how your marketing efforts are fueling sales and growth.

- Defend Your Budget: When budget cuts are on the table, ROI data is your best shield. It’s hard to cut a department that generates more than it costs.

- Advocate for More Resources: When you can show that every dollar you get yields a multiple in return, asking for a bigger budget isn't a request—it's a smart business case.

A strong lead generation ROI calculation doesn't just measure what you've done. It hands you a clear roadmap for future growth, showing you exactly where to double down and where to pull back. It turns your marketing strategy into a precise, data-driven operation.

Drive Smarter, Data-Backed Decisions

Guesswork has no place in a modern marketing or sales strategy. ROI data brings the clarity you need to optimize your efforts with confidence. You can finally stop wondering and start knowing where to put your time and money.

For instance, what if you discover your email campaigns are delivering a 300% ROI, but your paid social ads are barely breaking even? The next move becomes crystal clear. You can shift your budget to what's working, hit pause on underperforming initiatives, or dig deeper to figure out why certain channels are lagging behind.

Connect Your Efforts Directly to Revenue

Ultimately, this is all about drawing a clean line from your daily activities to the company's bottom line. For a sales professional, it's about showing how a targeted outreach campaign generated high-value deals. For recruiters, it's proving how a sourcing campaign led to a critical hire that moved the company forward.

This direct connection is empowering. Marketers can fine-tune their messaging, sales pros can focus on the leads most likely to close, and recruiters can prove the real value of their talent pipelines. When you master a few fundamental lead generation best practices, you ensure that every effort you make produces a measurable financial result.

Nailing Down the Numbers for a Real ROI Calculation

Any lead generation ROI calculation is only as good as the data you feed it. Let's walk through how to gather the essential numbers—your investment, your leads, and your revenue—without getting bogged down in spreadsheets.

The whole process kicks off with tracking down every single cost tied to your campaign. A classic mistake is just counting the obvious stuff, like ad spend. But if you want the real picture, you have to account for everything that went into the effort.

Tracking Your Total Investment

To get the "I" in ROI right, you have to dig deeper than the most visible costs. Your total investment is a mix of all direct, indirect, and sometimes hidden expenses.

- Direct Costs: This is the money you spent directly on the campaign, like your pay-per-click (PPC) ad budget, software subscriptions (think CRMs or email marketing tools), and any fees you paid to agencies or freelancers.

- Labor Costs: This is the one that gets missed most often. You need to calculate the hourly rate of everyone involved—your sales team, marketers, content creators—and multiply it by the hours they poured into the campaign. Time is money, and it’s a huge part of your investment.

- Content and Creative Costs: Did you create a new landing page, produce a video, or design graphics? All the costs that went into creating those assets, whether it was internal hours or payments to a designer, need to be in the mix.

Capturing every single cost is non-negotiable. That $50/month software subscription and the 10 hours your marketing manager spent on strategy both count. Underestimate your investment, and you’ll end up with an inflated, misleading ROI.

Collecting High-Quality Lead Generation Data

Once you’ve tallied up your total investment, it's time to gather data on the leads you generated. This isn't just about a raw headcount of contacts; it’s about understanding the efficiency and quality of your process. How you collect this data has a massive impact on both your costs and your eventual success.

The traditional method is a time-consuming manual slog. A researcher or sales rep would spend hours copying and pasting names, job titles, and contact details from websites into a spreadsheet. Not only is this method slow and prone to human error, but it also inflates your labor costs, dragging down your ROI before you've even made the first call.

This is a common challenge where modern, automated tools offer a solution. ProfileSpider, for example, is a one-click browser extension built to eliminate this manual grind. It shows how a modern, no-code alternative can overcome the inefficiencies of traditional scraping.

Here’s a look at the ProfileSpider interface, ready to pull profiles from a webpage with a single click.

This shows how a simple tool can instantly transform unstructured web data into a clean, exportable list of leads. It’s a massive time-saver that directly slashes the cost of prospecting.

Instead of burning an entire afternoon just to build a small list, you can extract hundreds of structured profiles from any website in seconds. This one-click workflow drastically cuts the labor costs tied to lead generation, making your initial investment far more efficient. Of course, keeping that data accurate over time is just as important. For more on that, check out our guide on the importance of lead data freshness.

Pinpointing Your Revenue Data

The last piece of the puzzle is tracking the revenue your campaign brought in. This demands a clean, organized way to trace sales all the way back to their original lead source. Your Customer Relationship Management (CRM) software is your best friend here.

A properly set-up CRM should automatically tag every new lead with its source—think "LinkedIn Ad Campaign," "Organic Search," or "Webinar Sign-up." When a deal closes, that revenue gets credited back to the campaign that delivered the customer.

To keep your numbers straight:

- Use UTM Parameters: For any digital campaign, use consistent UTM parameters in your links. This automatically tags traffic sources in your analytics and CRM, leaving no room for guesswork.

- Maintain CRM Hygiene: Regularly clean your CRM data. Get rid of duplicates and make sure every lead is tagged correctly. Bad source attribution will completely wreck your ROI calculation.

- Account for the Sales Cycle: Don't forget that revenue doesn't always show up overnight. If your average sales cycle is 60 days, you need to measure your ROI over at least that long to capture the deals that take more time to close.

The cost per lead (CPL) has become a make-or-break metric for ROI, and the costs can swing wildly depending on the channel. The data shows online retargeting and SEO are the most budget-friendly, coming in at around $31 per lead. On the other end of the spectrum, events and trade shows can cost a whopping $811 per lead.

For anyone using an AI profile extraction tool like ProfileSpider to build out their lead lists, this is critical information. Automation can bring your CPL way down by eliminating manual research and letting you target with laser precision. You can discover more insights about lead generation costs and statistics here.

The Essential Formulas for Measuring Lead ROI

Alright, you've gathered your data. Now it's time to do the math. The actual formulas are surprisingly simple. Mastering them is how you turn a spreadsheet of numbers into a clear verdict on your campaign's performance.

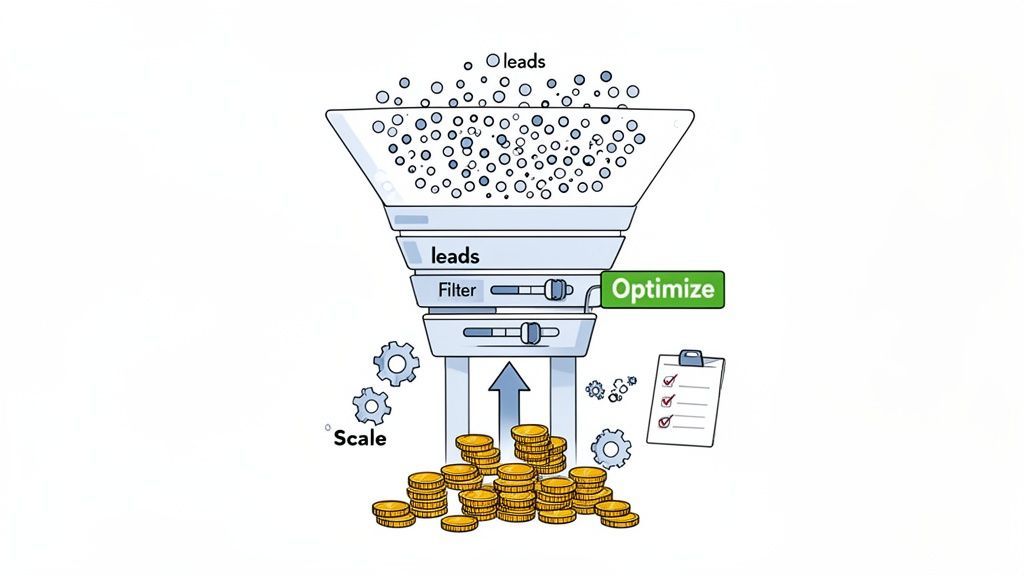

Think of the whole process as a logical journey from your initial investment to the final revenue you bring in.

This flow—Investment to Leads to Revenue—is the backbone of any solid ROI calculation. Let's break down the formulas you'll need.

The Foundational Lead Generation ROI Formula

At its heart, the classic ROI formula answers one simple question: "For every dollar we spent, how much did we get back?" It's the ultimate measure of efficiency and the first number any stakeholder is going to ask for.

The formula itself is straightforward:

ROI (%) = [(Revenue - Investment) / Investment] x 100

This percentage gives you the net return on your campaign. If it's a positive number, you made money. If it's negative, you lost money.

Let's Walk Through a Real-World Example

Imagine your marketing team launched a content campaign for a new eBook.

- Total Investment: $10,000. This covers everything—content creation, ad spend, and the team's time.

- Revenue Generated: $45,000. This is the total value of new customers who downloaded the eBook and eventually bought something.

Plugging those numbers into the formula:

ROI = [($45,000 - $10,000) / $10,000] x 100

ROI = ($35,000 / $10,000) x 100

ROI = 350%

That 350% is a powerful number. It means that for every single dollar you put into that campaign, you got $3.50 back in pure profit. That’s a metric that gets leadership's attention.

Going Deeper with Supporting Metrics

While the main ROI formula gives you the big-picture summary, a couple of other metrics provide the why behind the number. They help you diagnose your performance and find spots to improve. The two most critical are Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV).

Calculating Customer Acquisition Cost (CAC)

Your CAC tells you, on average, exactly what it costs to sign a single new customer. It’s a crucial health check for your entire sales and marketing operation.

Here’s the formula:

CAC = Total Sales and Marketing Investment / Number of New Customers Acquired

A lower CAC is almost always better. It means you're getting new customers on board more efficiently.

Here's a Sales Team Example

Let's say a sales team runs a direct outreach campaign using a targeted list of leads.

- Total Investment: $15,000. This includes their software subscription for lead extraction (like ProfileSpider), CRM costs, and the sales reps' salaries for the time spent on the campaign.

- New Customers Acquired: 30.

Let's calculate:

CAC = $15,000 / 30

CAC = $500

The team now knows it costs them $500 to land one new customer using this channel. This is essential for budgeting and forecasting. Now they can confidently say, "If we want to get 100 new customers next quarter, we need to budget $50,000 for this campaign."

Understanding Customer Lifetime Value (LTV)

LTV is a predictive metric. It estimates the total revenue you can expect to earn from a single customer over their entire relationship with your business. This is a game-changer because it forces you to think beyond the first sale and focus on long-term value.

A simplified LTV formula looks like this:

LTV = Average Purchase Value x Purchase Frequency x Average Customer Lifespan

Example from a Recruiting Agency

A recruiting agency wants to figure out the long-term value of the clients they sign.

- Average Placement Fee (Purchase Value): $20,000

- Average Placements per Year (Purchase Frequency): 3

- Average Client Relationship (Lifespan): 4 years

Let's do the math:

LTV = $20,000 x 3 x 4

LTV = $240,000

That's a powerful insight. The agency now knows that, on average, a new client is worth $240,000 to the business over time.

Why the LTV to CAC Ratio Is the Real Power Metric

This is where it all comes together. When you compare your LTV to your CAC, you get the most telling view of your business's long-term sustainability. The LTV:CAC ratio shows you how much value you're generating for every dollar you spend to get a customer.

Most healthy businesses aim for an LTV:CAC ratio of 3:1 or higher. This means for every dollar you spend acquiring a customer, you're getting at least three dollars back over their lifetime.

- A 1:1 ratio is a red flag. You're basically losing money on every new customer once you factor in the costs of running your business.

- A 5:1 ratio or higher is fantastic. It might even signal that you're underinvesting in marketing and could grow even faster if you spent more to acquire customers.

By getting comfortable with these formulas, you're moving beyond counting leads and into having strategic conversations about profit, efficiency, and sustainable growth. For a deeper dive into these and other key performance indicators, you can learn more about essential B2B lead generation metrics in our related article.

Turning ROI Analysis Into Actionable Strategy

Alright, you've run the numbers and you have your lead generation ROI. Whether it's a stellar 500% or a more sobering 50%, that figure isn't the finish line—it's the starting gun.

That number is just a diagnostic tool. The real magic happens when you use that insight to make smarter, faster decisions that actually move the needle. A low ROI isn't a failure; it’s a bright, flashing arrow pointing you exactly where you need to focus your attention.

This is the point where you stop being a scorekeeper and start acting like a strategist. You begin asking the right questions: Is our cost per lead too high? Are our conversion rates lagging? Is one specific channel secretly carrying all the weight? Answering these turns a simple metric into a powerful roadmap for growth.

Diagnosing the 'Why' Behind Your ROI

Once you have your ROI, the next move is to dissect it. A low number can come from a handful of common culprits. By isolating the real problem, you can apply a targeted fix instead of just throwing ideas at the wall and hoping something sticks.

Think of it like a doctor. They don't just note a patient's fever; they investigate the cause of the fever. In the same way, you need to look past the final ROI percentage and examine the health of your entire lead generation funnel.

A classic mistake is abandoning a channel entirely after a poor initial ROI. More often than not, the channel isn't the problem—it's the strategy. A few smart adjustments can completely flip its performance.

A Framework for Channel-Specific Improvements

Your ROI data is going to make it painfully obvious which channels are your all-stars and which are draining your budget. The game plan is simple: double down on what’s working and either fix or cut what isn’t.

- For High-ROI Channels: The question isn't just "How do we do more?" It's "How do we scale this without breaking it?" When a channel is already crushing it, even small optimizations can produce huge returns.

- For Low-ROI Channels: Before you pull the plug, play detective. Is the issue with the ad creative? The landing page experience? The offer itself? Or are you just attracting low-quality leads from that source?

It’s worth noting that email marketing consistently sets the bar for ROI. The data is clear: for every dollar spent, businesses average a $36 return—that's a massive 3,600% ROI. Its combination of reliable returns and simple tracking makes it a non-negotiable part of any serious lead gen strategy.

Troubleshooting Low ROI Scenarios

When your ROI isn't where you want it to be, it's easy to get frustrated. But a low number is just a symptom of an underlying issue. This table is a quick diagnostic tool to help you connect common symptoms to their likely causes and find a way forward.

| Symptom | Potential Cause | Actionable Solution |

|---|---|---|

| High Cost Per Lead (CPL) | Ad targeting is too broad or competitive. | Refine your audience targeting. Focus on long-tail keywords or niche demographics to reduce competition and improve relevance. |

| Low Lead-to-Customer Rate | Your offer isn't compelling, or the sales process is leaky. | A/B test your landing page offers and CTAs. Review your sales follow-up process to identify and plug any gaps. |

| High Volume, Low Quality Leads | Your lead magnet attracts freebie-seekers, not serious buyers. | Qualify leads more aggressively. Use more detailed forms or offer content that appeals directly to your ideal customer profile. |

| One Channel Dominates ROI | Over-reliance on a single source, creating risk. | Diversify your lead sources. Reinvest a small portion of the high-performing channel's budget into testing new platforms. |

Think of this table as a starting point. Dig into your own data, identify the patterns, and test your way to a better strategy. A low ROI today is just an opportunity for a higher ROI tomorrow.

Boost Your ROI with Better Lead Data

One of the quickest ways to fix a weak ROI is to improve the quality of your leads right from the start. Sending the world's best marketing message to the wrong person is a guaranteed way to burn cash and kill your conversion rates.

This is where modern lead generation tools give you a serious edge. Instead of casting a wide, expensive net, you can build laser-focused lists of your ideal prospects. For example, with a no-code scraper like ProfileSpider, you can instantly pull structured contact data from virtually any website—think professional networks, company team pages, or industry directories.

When you start with a high-quality, relevant list, your outreach is immediately more impactful. This naturally boosts engagement and conversion rates, which in turn drives up your overall ROI. Better leads simply mean less wasted effort and more closed deals.

For more on this, check out our guide on how to effectively market your lead list and squeeze every bit of value from it.

Common Pitfalls in ROI Calculation and How to Avoid Them

Even with all the right formulas laid out, getting an accurate read on your lead generation ROI can be surprisingly tough. Small, seemingly harmless mistakes can quietly skew your numbers, leading you to make poor decisions based on flawed data.

It's often the subtle oversights that cause the most damage.

One of the biggest culprits is under-tracking your total investment. It’s easy to count ad spend and software fees. But what about the 15 hours your sales team sank into manually researching and cleaning up a lead list? Those labor costs are a very real, significant part of your investment and have to be included if you want an honest ROI. This is a common challenge that ProfileSpider helps overcome by automating the manual data collection process, reducing hidden labor costs.

Another classic mistake is messy revenue attribution. A customer might see a social media ad, read a blog post a week later, and then finally click an email link to make a purchase. If you only give credit to that final email click, you’re completely ignoring the value of your social media and content efforts. That's how you end up mistakenly cutting the budgets of channels that are actually working.

Misinterpreting Metrics and Timelines

Focusing on vanity metrics instead of KPIs that actually drive revenue is a trap many fall into. A campaign that racks up thousands of "likes" but zero sales has a negative ROI, no matter how great the engagement numbers look. The only metrics that truly matter are the ones you can connect directly to the bottom line, like Customer Acquisition Cost (CAC) and your lead-to-customer conversion rate.

On a similar note, ignoring the long-term value of a lead can give you a dangerously shortsighted view of a campaign's success. A lead might not buy something right away, but their future purchases and referrals can dramatically increase their overall value down the line.

A lead that costs $50 to acquire but turns into a $5,000 customer with high lifetime value is infinitely more valuable than a $5 lead who never buys anything. Measuring ROI too soon can trick you into abandoning campaigns that are busy building a pipeline of future revenue.

Ignoring the Compounding Value of Long-Term Plays

This short-term thinking is especially damaging for strategies like content marketing, where the real returns take time to build. Content marketing shows incredible long-term ROI growth, with cumulative returns that multiply substantially over a three-year period.

Real-world data shows an average Year 1 return of $0.7 million (367% ROI), which explodes to $1.9 million (1,167% ROI) in Year 2, and hits $2.7 million (1,700% ROI) by Year 3. This compounding effect happens because businesses with active blogs generate, on average, 13 times more leads. You can dig deeper into these content marketing ROI findings on First Page Sage.

So, how do you sidestep these common pitfalls? It takes a disciplined approach.

- Track Everything: Use simple tools to log all the time and expenses tied to a campaign, not just the obvious line items.

- Use UTM Parameters: Get religious about implementing consistent UTM tracking on all your links. This is how you trace every lead and every sale back to its exact source.

- Focus on LTV: Shift your perspective from the first sale to the total lifetime value (LTV) of a customer. It's the only way to grasp the full financial impact of your marketing.

By building a more resilient and accurate measurement system, you'll stop making guesses and start making informed, data-driven decisions that fuel real, sustainable growth.

Got Questions About Lead Gen ROI? We've Got Answers.

Even when you have the formulas down, putting lead generation ROI into practice brings up a new set of questions. Here are some of the most common things we hear from sales pros, recruiters, and marketers once they start digging into their own numbers.

How Often Should I Be Calculating This?

The answer depends entirely on your sales cycle.

A business with a fast-moving sales cycle of just a few days or weeks should run the numbers on a weekly or bi-weekly basis. This gives you a near real-time pulse on what's working, so you can shift budget and tactics on the fly.

But if you're in B2B enterprise sales, your sales cycle is probably months long. Calculating ROI every week would be frustrating and misleading. A monthly or quarterly review makes more sense. It gives your leads enough time to move through the pipeline and turn into revenue.

The bottom line: Match your ROI calculation frequency to your average sales cycle. That’s how you get a true picture of your campaign’s impact instead of just a snapshot of initial activity.

What's a "Good" ROI for Lead Generation, Anyway?

Everyone wants a magic number, and a 5:1 ratio (a 500% ROI) is a solid benchmark. That means for every dollar you put in, you get five dollars back.

But "good" is completely relative. It really comes down to your specific business:

- Industry and Margins: A business with razor-thin margins might need a 10:1 ROI just to stay healthy. A high-margin SaaS company could be ecstatic with a 3:1 ratio.

- Business Stage: A startup hungry for market share might happily accept a lower ROI (maybe even 2:1) just to get customers in the door, banking on their long-term value (LTV).

- Campaign Goal: A top-of-funnel brand awareness campaign might have a low direct ROI, but its real value could be in warming up the market and drastically lowering your Customer Acquisition Cost (CAC) on other channels later on.

A good ROI is simply one that fuels your business goals and lets you grow without burning through cash.

How Do I Track ROI When My Sales Cycle Takes Forever?

This is the classic challenge for B2B marketers. It’s tough, but absolutely doable. You just have to shift your thinking from immediate, closed deals to leading indicators.

Instead of staring at an empty revenue column for months, start tracking pipeline-influenced ROI. Look at the valuable milestones your leads are hitting along the way. How many marketing qualified leads (MQLs) or sales-accepted leads (SALs) did your campaign generate?

You can then assign an estimated dollar value to those stages based on your historical conversion rates. This gives you a forward-looking, predictive measure of a campaign’s health long before the contracts are signed.

What Are the Best Tools for Tracking All This?

You don't need a massive, complicated tech stack to get this right. In fact, you can get incredibly far with just a few key tools.

- Your CRM: This is your source of truth. Something like HubSpot or Salesforce is non-negotiable for connecting leads, deals, and revenue back to the campaign that started it all.

- Analytics Platforms: You need to know where your leads are coming from. Google Analytics is the go-to for tracking which web pages and marketing channels are actually turning visitors into conversions.

- Spreadsheets: Never underestimate the power of a good old-fashioned spreadsheet. Google Sheets or Excel are perfect for pulling together all your costs—ad spend, contractor fees, software licenses—into one master view for your ROI calculations.

- Lead Generation Tools: To get a handle on the "investment" part of the equation, tools like ProfileSpider are crucial. They help you measure the time and manual effort you're saving on prospecting, giving you a much more accurate look at the true cost of acquiring your leads.